Table of Content

You are a current/former military member who has either served a minimum of 181 consecutive days during peacetime or a minimum of 90 consecutive days during wartime. Veterans are in the clear, but if you are an active military member, you might get a PCS. A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. Customers with questions regarding our loan officers and their licensing may visit the Nationwide Mortgage Licensing System & Directoryfor more information. A Veteran Affairs loan is a mortgage loan for Service members, Veterans and eligible surviving spouses.

They come with a funding fee, which is paid to support the program. The last way to reduce your monthly payment is by making a downpayment to reduce your monthly expenses and help you save thousands. The homeowner’s insurance premium is the amount you pay annually to keep your policy alive. In the case of a mortgage, you would have to pay the premium as part of your monthly installments.

How to Use a VA Mortgage Calculator to Estimate Your Monthly Mortgage Payment

Your rate may differ based on a variety of factors, including your credit score and the current market conditions. To get your personalized interest rate, start your quote online. When it’s time for closing, you’ll have a number of fees owed directly to the mortgage lender. These cover origination points, broker fees, commitment fees, document preparation, processing, tax service and underwriting. Each lender will charge its own origination fees; there’s no standard measure for each cost. One of the first things to add on to your mortgage payment on top of principal and interest are property taxes.

This is perhaps the most meaningful benefit offered by Virginia Housing. Qualified first-time buyers can receive up to 2.5% of a home’s purchase price to apply to a down payment — no repayment required. The grant is combined with a Virginia Housing loan, and household income limits are considered. Just because you have a high DTI ratio doesn't mean you can't still qualify for a home loan. Lenders will look at your credit score, savings, assets, down payment and property value in addition to your DTI when considering your loan eligibility.

More Calculators

This may influence which products we write about and where and how the product appears on a page. Virginia, lovingly called Old Dominion, has the 11th most expensive housing market in the U.S., but that may seem understated for residents in Northern Virginia. Home prices have been rising rapidly in Northern Virginia, increasing by 150% in the last twenty years. So, while some say Virginia is for lovers, it's clear that it is also for homeowners.

The "total monthly cost" estimates your monthly VA mortgage payment, including estimated costs for property taxes and home insurance. The "total cost" is how much you'll pay over the life of the loan, including the VA funding fee. Use this calculator to help estimate the monthly payments on a VA home loan. Enter your closing date, the sale price, your military status & quickly see the monthly costs of buying a home. Before your monthly payments start, you’ll have to pay a slew of additional costs on your mortgage closing day.

What Does a VA Loan Cost?

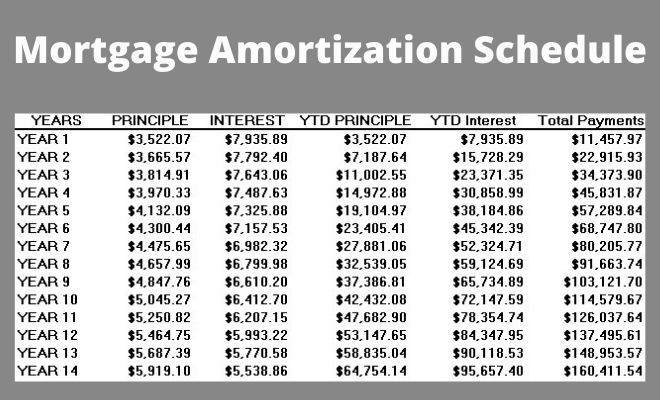

Typically, the factors affecting your monthly payment include the home price, down payment, interest rate, and if you have to pay the VA funding fee. An amortization schedule for a VA loan is a breakdown of your monthly VA mortgage payments over the life of the loan. Amortization tables typically break down the principal and interest paid over time. Conventional loans when it comes to credit scores and debt-to-income ratios. While a VA loan typically requires no down payment, making one will reduce the size of your mortgage and reduce the VA funding fee, too. The VA loan calculator automatically factors in your VA funding fee.

The VA loan calculator is useful for home buyers and homeowners to see how much they need to pay with a veterans loan. VA mortgage calculatorUse our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families. Interest rates used in the VA mortgage calculator are shown for illustrative purposes only and are estimated based on the current market average for your provided loan scenario.

VA single close construction loan

However, if you’re thinking of building, you should consider various factors for construction costs and unforeseen situations. Thankfully, GO Mortgage offers VA loans and has a proven track record of fantastic service. VAMortgageCenter is NOT affiliated with any government agencies, including the VA. And if you’re looking for more information about life in the Old Dominion, we have you covered.

APR gives you an accurate idea of the cost of a financing offer, highlighting the relationship between rate and fees. Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association fees to collectively pay for amenities, maintenance and some insurance. Although this can include a range of costs, from grocery bills to streaming services, some of the largest expenses include auto payments, credit card payments and utilities. Our calculator uses information from you about your income, monthly expenses and loan term to calculate an estimate of what you may be able to afford. Here's a more in-depth look at DTIs, which lenders use to ensure you have enough income to pay both a new mortgage and other monthly debts.

Credit Report—This fee is paid to credit agencies to evaluate the credit history of a potential borrower. Loan Discount Points—Charged in order to receive interest rates lower than current market rates. Two discount points (2%), or less, is considered to be reasonable. Manufactured homes, or mobile homes that are not permanently affixed, have a fixed rate of 1.00%. A loan assumption allows a third party to step in and take over the remainder of the loan without a new mortgage.

However, if you decide to put money down, it can reduce the VA funding fee - if required - and your overall monthly payment. Interest rates in the calculator include APR, which estimates closing costs and fees and is the actual cost of borrowing. Interest rates in the calculator are for educational purposes only, and your interest rate may differ. Loan Term Loan term is the length you wish to borrow - typically 15 or 30 years. Credit Score Interest rates typically vary based on several factors, including credit score. Estimate your credit score for a more accurate VA loan payment.

There is no mortgage insurance involved, relieving VA loan borrowers of a big expense. Hazard Insurance and Real Estate Taxes—Necessary to insure payment of taxes and insurance during the first year. If your lender does not allow a big enough loan for your home purchase, shop around.

Another resource available to homebuyers is the Virginia Department of Housing and Community Development . If you’re interested in the latter, you need to be a first-time homebuyer at or below 80% of the area median income. State recordation tax is $0.25/$100 or 0.25% for amounts under $10 million and is usually paid by the buyer. Another fee is grantor tax, which can be calculated as 0.1% or $0.50/$500, whichever is greater. Some areas of Virginia have additional local recordation taxes as well.

Steps To Acquiring A VA Home Loan

Closing Costs - There are certain fees and expenses that the seller cannot pay when a VA home loan is being used to purchase a house. For instance, courier fees and document recording costs are generally the responsibility of the buyer. Although they aren't usually terribly expensive, they should still be taken into consideration when calculating how much you can afford to spend. Also, miscellaneous VA loan fees are going to be your responsibility, as is the cost of termite inspections - if they are required. As noted previously, the interest rates for VA home loans are generally quite a bit lower than for traditional mortgage products. In fact, this is one of their major selling points and is the main reason why so many people are sold on them.

No comments:

Post a Comment